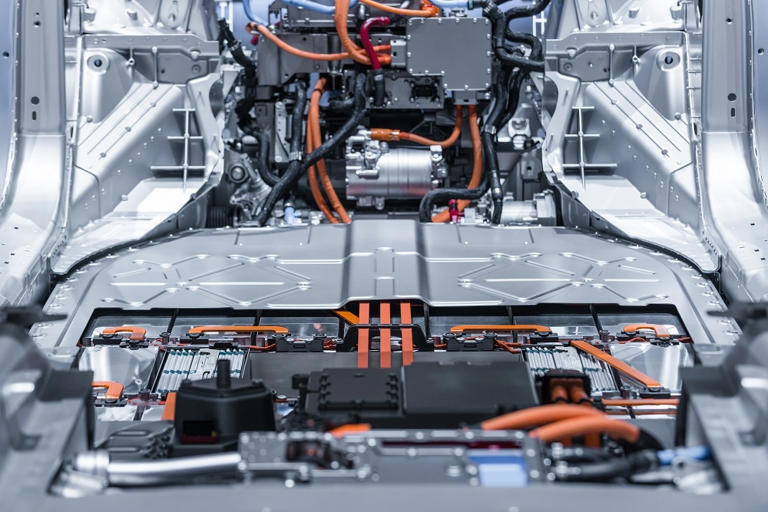

KUALA LUMPUR, March 5 — The lithium-ion battery powering your sleek new electric vehicles (EV) and hybrid cars may last eight to 10 years, but what happens after that?

This question is becoming increasingly urgent for Malaysia as the country embraces the electric vehicle revolution. Automotive giants like Tesla and BYD have established local operations, and homegrown automaker like Proton venturing into the EV market.

Whilst the nation pushes towards 10,000 charging stations by 2025 and greater EV adoption, the lifecycle of lithium-ion batteries — typically eight to 10 years — presents a mounting environmental challenge. By 2050, Malaysia will need to process 870,000 depleted batteries, for which robust systems for collection, processing and material recovery are critical.

“As the sector is still at the infant stage, there is no precise data currently available on the capacity of hybrid and EV battery processing in Malaysia, but internal projections by MARii indicate a significant increase in the number of EV batteries requiring recycling in the coming years. This trend will largely depend on the total industry volume (TIV) and future market growth,” Malaysia Automotive, Robotics and IoT Institute (MARii) chief executive, Azrul Reza Aziz told Malay Mail.

He added that based on an eight-year battery lifecycle and EV registration data from 2020, projections indicate that 40,000 EV batteries will require recycling by 2030, rising to 330,000 by 2040 and 870,000 by 2050.

Presently, Malaysia has a comprehensive regulatory framework for the safe disposal of hybrid and electric vehicle (xEV) batteries, governed by the Department of Environment (DoE) through three key mechanisms:

- Authorised Automotive Treatment Facilities (AATF), which manage the dismantling of non-roadworthy xEVs and battery removal.

- Licensed recycling centres (Environmental Impact Assessment or EIA licensed), which conduct battery pre-treatment and processing in compliance with the Environmental Quality Act 1974.

- Scheduled Waste SW103 Protocol oversees the handling, storage, transport, and disposal of hazardous battery materials.

“Under the Extended Producer Responsibility (EPR) initiative, xEV manufacturers (OEMs) are required to direct non-roadworthy vehicles to AATFs, where batteries are collected and sent to licensed recycling centres. These facilities break down batteries into black powder, which can be extracted using hydrometallurgy for further industrial applications.

“To further enhance traceability and transparency, MARii is spearheading the development of a Battery Passport initiative. This digital record system will track key battery information, including composition, origin, lifecycle data, and recyclability, ensuring efficient resource management and compliance with global sustainability standards,” Azrul said.

He explained that this approach creates a closed-loop, cradle-to-cradle system, to reinforce Malaysia’s commitment to environmental sustainability while supporting the country’s green mobility transition.

MARii is an agency under the International Trade and Industry Ministry (Miti), which is tasked with shaping and steering Malaysia’s automotive industry through strategic leadership and policy development.

Only two licensed facilities in Malaysia for processing end-of-life batteries

Presently, there are only two DoE-licensed AATF: Car Medic Sdn Bhd and Jaring Metal Industries Sdn Bhd.

There are also four scheduled waste recycling facilities — Hi Tech Full Recovery (M) Sdn Bhd, Mep Enviro Technology Sdn Bhd, Sungeel Hitech Sdn Bhd, Tes-Amm (M) Sdn Bhd — approved by the DoE for processing SW103-type wastes, including batteries containing cadmium, nickel, mercury, or lithium.

“Malaysia is taking significant steps toward establishing a sustainable ecosystem for handling end-of-life (EOL) electric and hybrid vehicle batteries. MARii is actively promoting Licensed AATFs, sanctioned by the DoE, to manage used parts and components from EOL vehicles (ELV) and EOL Parts (ELP).

“These facilities comply with strict environmental laws and regulations, including MS 2697 certification, and operate under the 4R framework — reuse, repair, recycle, and remanufacture — covering powertrains for internal combustion engine (ICE), hybrid, and EVs,” Azrul added.

Driving private investment in battery recycling

There are two support schemes available to encourage private sector investment in battery recycling facilities, which are the Green Income Tax Exemption (GITE) and the Green Investment Tax Allowance (GITA), under the Malaysian Green Technology and Climate Change Corporation (MGTC) and the Malaysian Investment Development Authority (MIDA).

The GITE allows for a 70 per cent income tax exemption on a company’s statutory income for qualifying green services, from the year of assessment where the first invoice is issued after the application to MIDA, for the following services:

- EV charging stations

- EV infrastructure repairs

- EV maintenance activities

- EV installations

The GITA meanwhile, offers a 100 per cent allowance on qualifying capital expenditure for green technology projects, applicable from the first qualifying expenditure date after MIDA receives the application. This allowance permits an offset of up to 70 per cent against statutory income in the assessment year.

Preventing secondary environmental impacts from battery recycling

Malaysia has established a comprehensive framework to prevent secondary environmental impacts from battery recycling, anchored by robust carbon pricing mechanisms and waste management policies.

Miti addresses these challenges through two key policies: the National Automotive Policy 2020 (NAP 2020) and the National Remanufacturing Policy (NRP). NAP 2020 targets a 70 per cent recycling rate for ELVs, achieved through research and development and compliance with MS ISO:22628 standards. The policy aims to establish 21 licensed AATFs by 2030, ensuring minimal environmental impact and strict hazardous material management.

The NRP complements these efforts by fostering a sustainable circular economy across five strategic sectors: automotive, marine, machining, electrical and electronics, and aerospace. It focuses on enhancing local remanufacturing capabilities, boosting exports and protecting consumer interests through stringent regulations.

Sumber: MSN